共同プレスリリース:環境NGO、東証プライム4企業に対して株主提案〜メガバンク全3社含む日本企業の取締役のコンピテンシーに関する開示を要求〜(2024/4/15)

国際環境NGO マーケット・フォース

特定非営利活動法人 気候ネットワーク

レインフォレスト・アクション・ネットワーク(RAN)

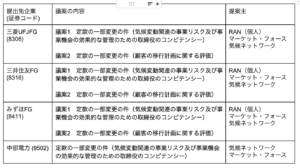

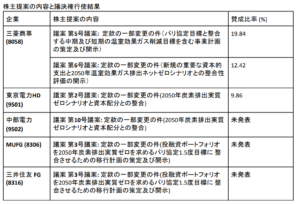

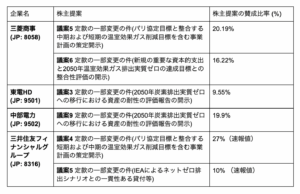

国内外の環境NGOとその代表者を含む個人株主は4月15日までに、金融、電力の2業界の4企業(三菱UFJフィナンシャル・グループ、三井住友フィナンシャルグループ、みずほフィナンシャルグループ、日本最大の発電会社・JERAの経営に大きく関与する中部電力)に対し、気候変動対策の強化を求める株主提案を提出しました。

我々は関連企業との対話を続けてきましたが、より一層の気候変動対策への注力を期待し、今年は企業の取締役会に焦点を当てた提案を提出しています。提出先企業の取締役会が、気候関連事業リスク及び機会の適切な監督を行う上で必要な能力あるいは人材を備えているか、株主が評価する上で必要な情報開示を求める議案となっています。

株主提案

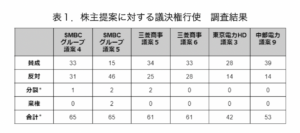

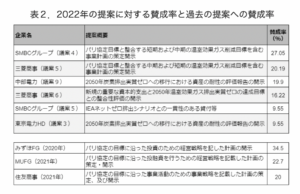

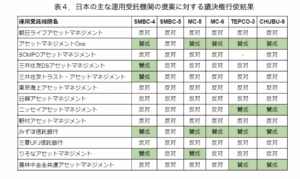

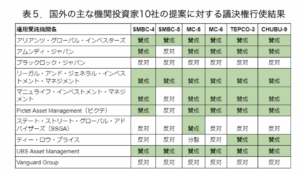

昨年の株主総会シーズンで日本企業は過去最多の気候変動に関する株主提案に直面しました。近年、このような株主提案は環境NGOに限らず、国外の機関投資家や地方自治体からも提案されています。多様なステークホルダーが高炭素排出企業による気候変動対策の遅れに対して、広範囲に及ぶ悪影響のみならず、企業価値の低下を招くとの危機意識を共有し、行動に移しています。我々が提出した議案も機関投資家に幅広く支持されました。

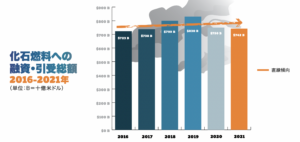

メガバンク3社については、気候変動への公約及び気候変動リスク管理戦略を踏まえ、これらの実効性を株主が判断できることが重要です。化石燃料セクターの顧客の移行計画とパリ協定1.5℃目標との整合性について、メガバンク各社がどのように評価を行うか、そして当該セクター顧客がパリ協定に沿った信頼性の高い移行計画を作成しなかった場合、新規資金の制限を含む、対応措置をどのようにとるのかの開示を求めています。

提出先企業が抱える問題の要点は以下の通りです(業界ごと)

■メガバンク

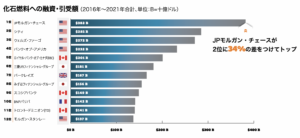

「メガバンクの気候変動対策は1.5度に気温上昇を抑えるために科学が明確に求めている行動水準からいまだに大きく乖離しており、このことは企業価値をリスクにさらします。特に、石油・ガスへのファイナンス方針においてアジアの銀行を含む競合他社から大きく遅れをとり、高リスクの事業に資金を提供し続けており、リスク管理能力が問われています。我々の2つの提案が可決されれば、メガバンクの取締役会に気候関連の事業リスクと機会を監督する能力が備わっているか、またメガバンクが重視する高排出企業への移行エンゲージメントの実効性について株主が評価できるようになるでしょう。ひいては、メガバンクの気候変動対策の強化に繋がり、企業価値の維持・向上にも資すると考えます。」

(マーケット・フォース, 日本・エネルギーファイナンスキャンペーン担当, 渡辺瑛莉)

「メガバンクは、融資先の移行計画への評価体制が緩い点が問題です。気候危機下で効果的な管理を行うための取締役など経営レベルでの専門性が不足しているように見えます。結果として、1.5℃目標の達成を困難にするような事業計画を持っている企業にも融資が継続されたり、また、銀行としての方針や管理体制が不十分なのではないかと私たちは懸念しています。例えば、LNGセクターでの事業拡大を進める企業への資金提供を継続し、MUFGとみずほは先住民族の人権を侵害している米国のリオ・グランデLNG事業でも重要な役割を果たしています。3行とも、木質バイオマス発電事業や農業など高炭素セクターでの生物由来CO2排出量の集計も行なっていません。メガバンクにはネットゼロにコミットし、脱炭素社会へのシステム移行をサポートする金融機関として、融資先企業や政府の移行計画の妥当性を見極め、対処する管理能力が問われています。」

(レインフォレスト・アクション・ネットワワーク, 日本シニア・アドバイザー, 川上豊幸)

■中部電力

「今年は特に『第7次エネルギー基本計画』についての検討が行われる重要な年です。中部電力およびJERAは、引き続き、水素・アンモニア、CCSの導入促進および原発再稼働で脱炭素を図るとしていますが、それらによる実質的な排出削減効果と経済性、さらに安全性の保障を鑑みれば、まったく解決策にはなっていません。根本的な方針転換をするには、会社経営を担う人たちに科学的知見を踏まえた判断をしていただく必要があります。真の脱炭素、再エネが主力となる社会に向かっていくには柔軟な考え方と思い切った転換が必要です。」

(気候ネットワーク, プログラム・コーディネーター, 鈴木康子)

「採掘から使用を含めた供給網全体で化石燃料からの脱却なしに気温上昇を1.5度以下に抑制することは極めて困難です。中部電力とJERAの移行計画は、1.5度目標のタイムラインに沿っているとは言えず、両社は大きな移行リスクを抱えるとともに気候変動の悪化を招こうとしています。中部電力の取締役会は真正かつ実効性のある移行計画を後押しする監督責任があり、今後厳しい目で見られることになるでしょう。そもそも、取締役会の気候リスク監督能力を株主が評価するための情報が不足しているのが現状です。」

(マーケット・フォース, エネルギーファイナンスアナリスト, 鈴木幸子)

株主提案の提出先企業に求める情報開示は、コーポレートガバナンス・コードの求め、及び投資家団体(CA100+やTPI等)、国際サステナビリティ基準審議会(ISSB)等を通じ、投資家が求める情報開示に合致しています。

また、株主提案を提出先となった企業は、座礁資産リスク(環境や市場、規制の変化で企業が将来的に減損処理する資産を抱えること)や訴訟リスク、ブランド価値の毀損など将来の企業価値に関する重大なリスクを抱えています。また、こうした企業が誤った戦略を取り続けると気候変動対策の妨げともなりかねません。

企業が我々の株主提案を真摯に受け止め、投資家の方々の後押しを受けて気候変動対策を強化するとともに情報開示を進めることが、企業価値の向上に繋がり、ひいては気候危機を防ぐ一助となるとして、ご理解を得られることを期待しています。

■ 株主提案に関する詳細

メガバンク3社(こちらから)

中部電力 (こちらから)

■ 株主提案に関する特設サイト

各社への提案書および投資家向け説明資料は特設サイトからもダウンロードいただけます。

Asia Shareholder Action: https://shareholderaction.asia/ja/

■ 株主提案の内容に関するお問合せ先

□ マーケット・フォース(Market Forces)https://www.marketforces.org.au

日本語窓口(松木):TEL:+81-80-4395-8529

担当者:Antony Balmain E-mail: contact[@]marketforces.org.au

Tel: +81-80 4395 8529

□ 気候ネットワーク

https://www.kikonet.org

東京事務所:TEL:+81-3-3263-9210

担当者:鈴木康子 E-mail: suzuki[@]kikonet.org

□ レインフォレスト・アクション・ネットワーク(RAN)

japan.ran.org

担当者:川上豊幸 E-mail: toyo[@]ran.org