声明:三井住友FG、2050年排出量ネットゼロを約束 (2021/9/3)

「森林破壊ゼロ、泥炭地開発ゼロ、搾取ゼロ」もパーム油など農園開発に要求

〜「TCFDレポート2021」発表に伴い方針強化、待たれる人権尊重〜

米環境NGOレインフォレスト・アクション・ネットワーク(本部:米国サンフランシスコ、日本代表部:東京都渋谷区、以下RAN)は、本日3日、三井住友フィナンシャルグループ(SMBC)が「SMBCグループ TCFDレポート 2021」を8月31日に公表(注1)したことを受けて以下の声明を発表し、パリ協定の目標に向けての方針強化であると歓迎しつつも、中期目標の設定を先送りしていると批判しました。

RAN日本代表 川上豊幸

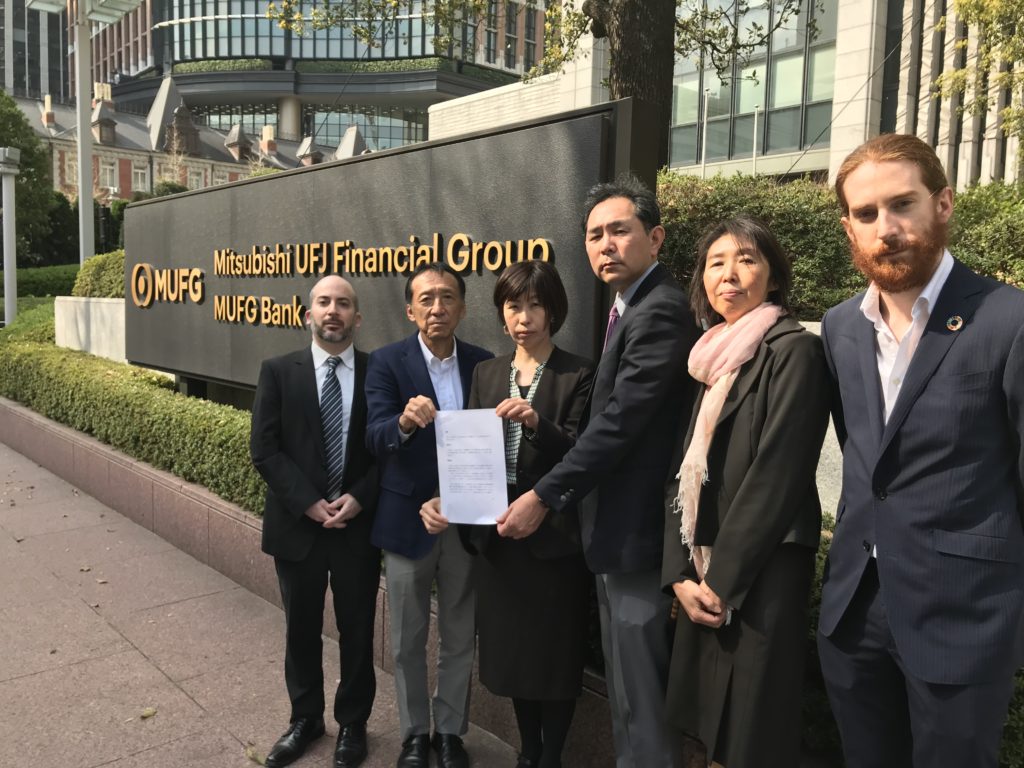

まず、SMBCが2050 年までに投融資ポートフォリオで温室効果ガス(GHG)排出量をネットゼロにすると約束したことは、パリ協定の目標達成に向けた方針強化と受け止めて歓迎します。「2050年ネットゼロ」は気温上昇を1.5度に抑えるために必要な長期目標で、日本政府も同様の目標を掲げています。気候危機を加速させている化石燃料への資金提供額がアジア5位のSMBCが、アジア首位の三菱UFJフィナンシャル・グループ(MUFG)(注2)に次いでコミットしたことは重要です。

しかし、投融資ポートフォリオのGHG排出量把握と中長期削減目標の開示は行われず、中期目標の開示は2023年に先送りされたことから、パリ協定への整合性を確認することができません。そして2030年までの限られた数年を目標策定に費やすことになり、緊急性に欠けます。また、投融資ポートフォリオGHG排出量の算定には、石油・ガス、電力セクターに加え、GHG排出に大きな影響を与えている石炭採掘を含めた化石燃料セクター全般、およびパーム油を含む森林関連セクターを早期に追加することが求められます。

第二に、今回のレポートでは、森林破壊の要因となるパーム油などの農園開発事業に対し、「森林破壊ゼロ、泥炭地開発ゼロ、搾取ゼロ方針」(※NDPE方針)を遵守する旨の公表を求めました。しかし、取引先には遵守の公表を求めるだけではなく、グループ全体およびサプライチェーンを含めた遵守状況をモニタリングし、不遵守状況への対応等を通じて、方針の実施と強化を進めることが必要です。また同基準は農園開発事業に限定され、各産品の購入企業には適用されていないことも課題です。MUFGも今年4月にパーム油セクターにNDPEを適用しましたが、同様の問題があります(注3)。

※No Deforestation, No Peat and No Exploitationの略

一方、森林伐採事業セクターでは違法労働への支援を行わないことを明記したものの、労働者の権利尊重や地域住民や先住民族の土地権尊重といった人権尊重が明記されていません。特に「自由意思による、事前の、十分な情報に基づく同意」(FPIC:Free, Prior and Informed Consent)(注4)の要件は追加されませんでした。NDPEと同様、FPIC 基準は国連「持続可能な開発目標」(SDGs)の達成や「国連ビジネスと人権に関する指導原則」(UNGP)への遵守に不可欠です。

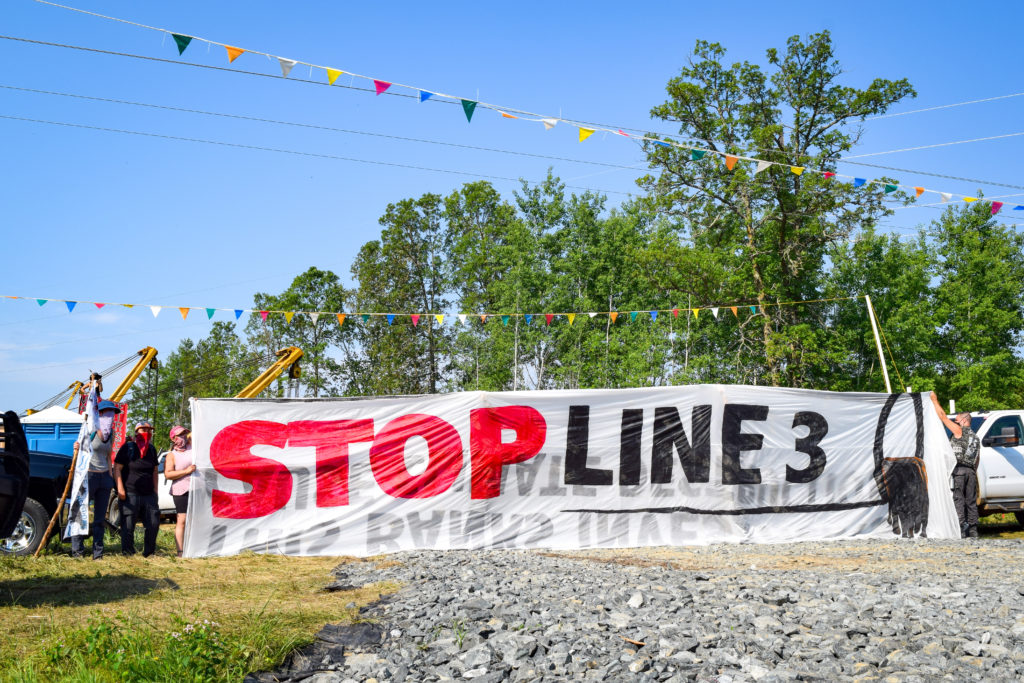

SMBCは前述の通り、パリ協定締結以降の化石燃料への資金提供額がアジア5位、世界18位であることが明らかになっています。また、3メガバンクは東南アジアの森林減少に加担している企業への最大の資金提供者に含まれます(注5)。 SMBCの融資先には、問題案件となっているベトナムおよびインドネシアの新規石炭火力発電所建設、インドネシアで人権侵害を伴うパーム油の農園(注6)、米国で先住民族らによる抵抗が続くオイルサンド・パイプライン(注7)等が含まれています。

注1 ) 三井住友フィナンシャルグループ、「SMBCグループ TCFDレポート 2021」の発行について」、2021年8月31日

注2)RAN他プレスリリース「『化石燃料ファイナンス成績表2021』発表〜世界60銀行、パリ協定後も化石燃料に3.8兆ドルを資金提供〜」、2021年3月24日

注3)NGO共同声明「MUFGが石炭火力・森林セクター方針を改定、なおパリ協定と整合せず」、2021年4月26日

注4)FPIC(エフピック)とは、先住民族と地域コミュニティが所有・利用してきた慣習地に影響を与える開発に対して、自由意志による、事前の、十分な情報を得た上で同意する、または同意しない権利のことをいう。

注5)RAN他「森林と金融データベース」より

参照:RAN他プレスリリース「『森林と金融』メガバンク等の森林方針の評価を発表」、2021年6月22日

注6)RAN、インドフードまたは同社グループ企業への投融資に関する銀行・投資家向けレター、2020年11月13日

注7)RAN声明「メガバンクが支援する北米パイプライン『ライン3』、活動家らの封鎖で工事中断」、2021年7月7日

本件に関するお問い合わせ先

レインフォレスト・アクション・ネットワーク

広報:関本 Email: yuki.sekimoto@ran.org