共同プレスリリース:「化石燃料ファイナンス報告書2022」発表 〜世界60銀行、パリ協定後も化石燃料に4.6兆ドルを資金提供〜(2022/3/31)

三菱UFJとみずほがトップ10入り、「ネットゼロ」宣言にも関わらず化石燃料拡大を支援

レインフォレスト・アクション・ネットワーク(RAN)

国際環境NGO 350.org Japan

気候ネットワーク

米環境NGO レインフォレスト・アクション・ネットワーク(本部:米国サンフランシスコ、日本代表部:東京都渋谷区、以下RAN)をはじめとするNGOは、30日(米国東海岸時間)、新報告書『化石燃料ファイナンス報告書2022〜気候カオスをもたらす銀行業務〜』(第13版、注1)を発表しました。

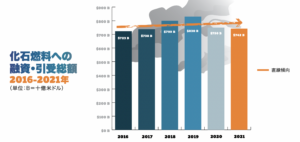

本報告書は世界の主要民間銀行による化石燃料への融資・引受をまとめたもので、分析の結果、邦銀4行を含む世界の60銀行は、パリ協定採択後の6年間で約4.6兆米ドルを化石燃料に資金提供し、2021年はパリ協定採択翌年の2016年よりも多い7,420億ドルが提供されたことが明らかになりました。化石燃料産業へ従来通り多額の資金提供が行われたことから、NGOは、気候変動対策の公約と実際の資金提供に大きなズレがあると批判しました。

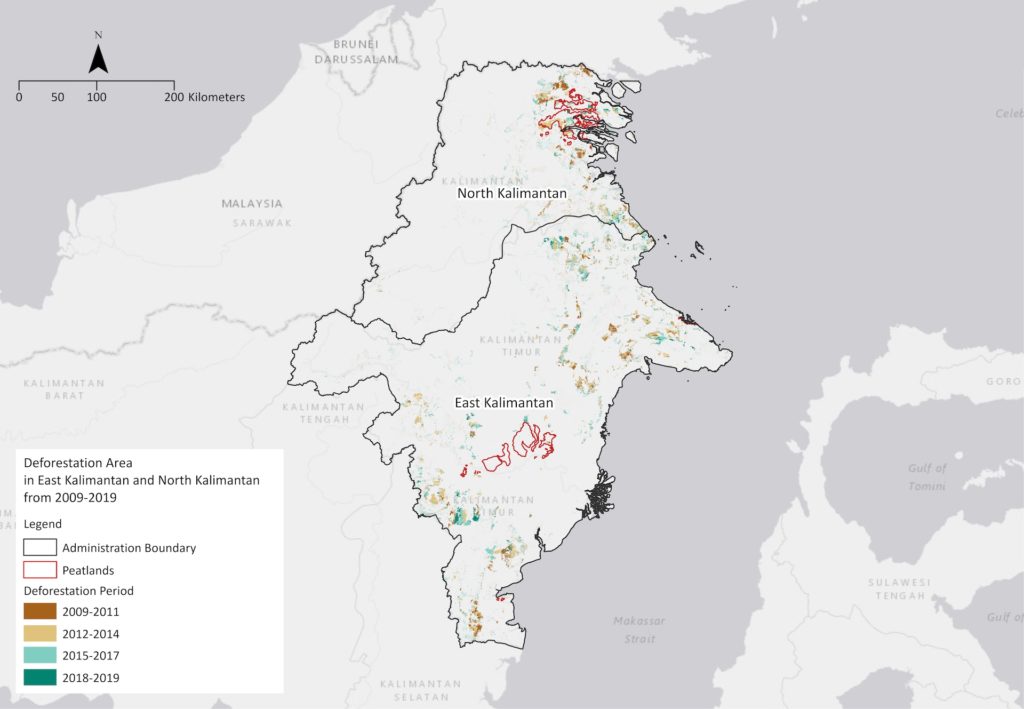

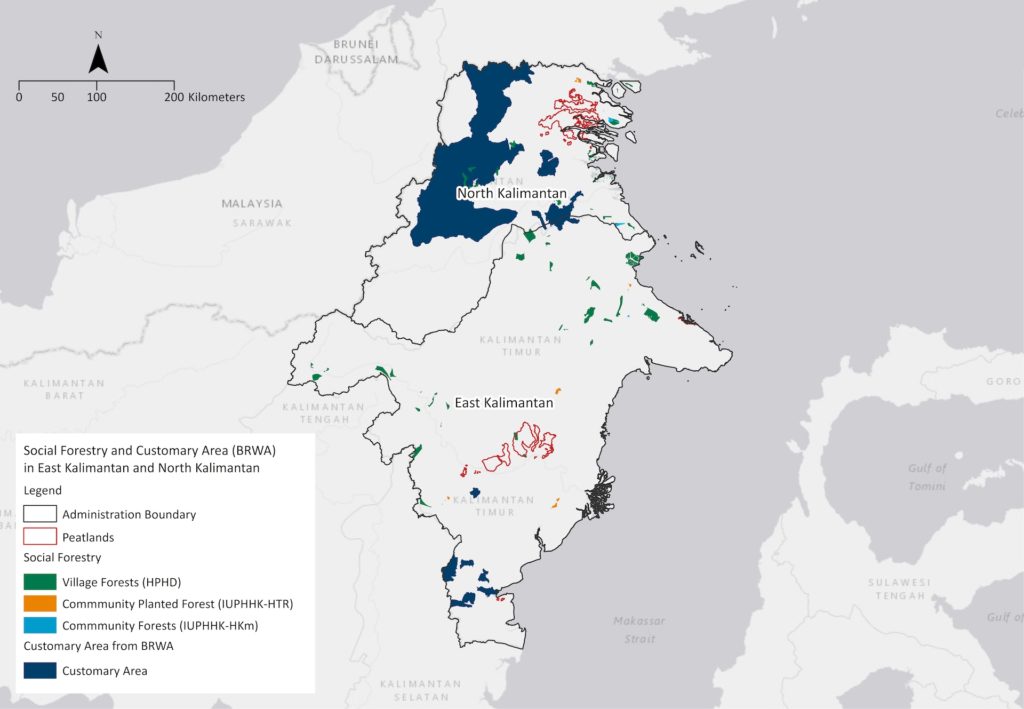

図1:化石燃料への融資・引受総額(2016年〜2021年、単位:B=十億米ドル)

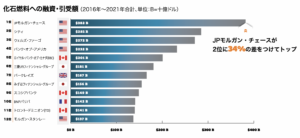

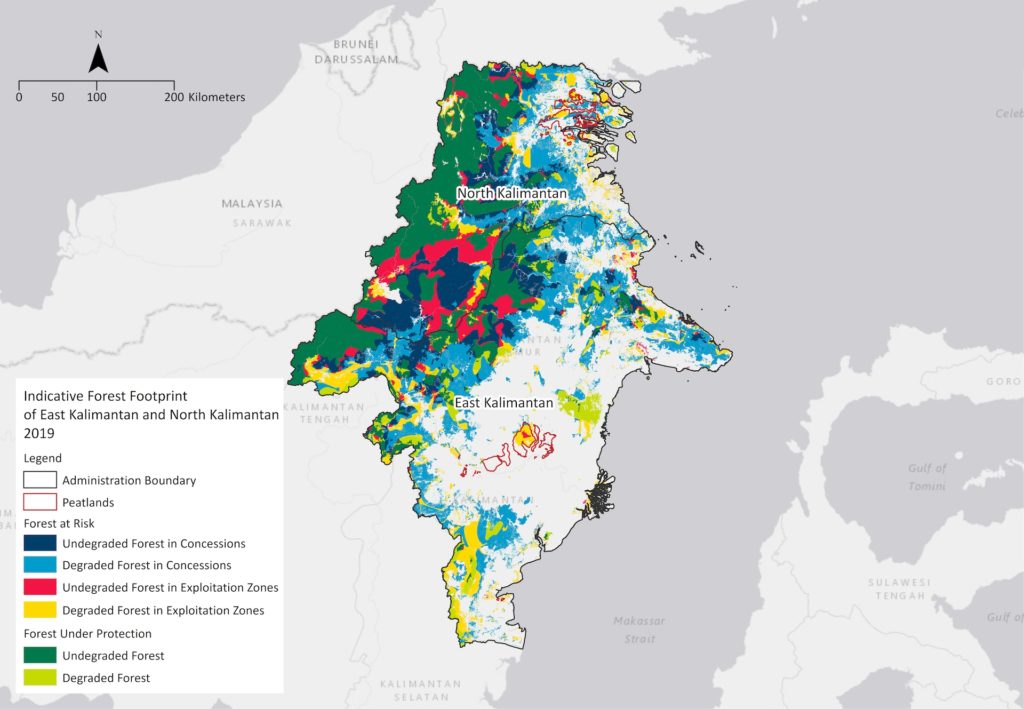

図2:パリ協定以降のワースト12銀行(化石燃料への融資・引受額、2016年〜2021年合計)

*他の邦銀順位は、18位 三井住友フィナンシャルグループ(SMBCグループ)、60位 三井住友トラスト・ホールディングス。

『化石燃料ファイナンス報告書2022』概要

●世界の主要民間銀行60行が化石燃料部門に行った資金提供を示した包括的な報告書。石炭、石油、ガス部門の約2,700社(親会社1,635社)に対する2016年〜2021年の6年間の融資・引受を分析の対象としている。

●世界の主要60銀行は、パリ協定採択後の6年間(2016年〜2021年)で合計4.6兆米ドルを化石燃料部門に資金提供し、2021年だけで7,420億ドルが提供された。2020年に続き、2021年の融資・引受額もパリ協定採択翌年である2016年の金額を上回った。また、対象の60行は新規建設・計画など化石燃料を拡大している企業の上位100社に昨年だけで1,855億ドルを提供した。

●全化石燃料部門への資金提供額の上位を独占したのは、前回に引き続き、以下の米国の4行だった。JPモルガン・チェース、シティ、ウェルズ・ファーゴ、バンク・オブ・アメリカの融資・引受額の合計は、パリ協定採択後の6年間(2016年〜2021年)に確認された総額の4分の1だった。

●JPモルガン・チェースは今回も化石燃料への融資・引受額が最多で、気候変動カオス(混乱)を引き起こす世界ワースト銀行だった。

●地域別上位銀行は、カナダでロイヤル・バンク・オブ・カナダ(RBC)、ヨーロッパで英バークレイズ、アジア及び日本では三菱UFJフィナンシャル・グループ(MUFG)。

●2020年から2021年に化石燃料への資金提供を増やした銀行は、JPモルガン・チェース、ウェルズ・ファーゴ、みずほフィナンシャルグループ、MUFG、そしてカナダの5行だった。

●ロシアのウクライナ侵攻で世界の石油・ガス市場が揺れる中、本報告書で取り扱ったロシア国営エネルギー大手のガスプロムへの融資・引受額が最も多かった銀行はJPモルガン・チェースで、2016年から2021年の合計、そして昨年だけでも最大の資金提供者だった。JPモルガン・チェースは2021年にガスプロムに11億ドルの化石燃料ファイナンスを行った。SMBCグループは2016年から2021年は世界3位で、2021年世界で同率2位。

RAN気候変動・エネルギー部門 政策方針・リサーチマネジャーのアリソン・カーシュは「化石燃料のさらなる拡大は、人類を何世代にもわたって気候変動による災害に陥れる危険性があります。しかし、世界の大手銀行が顧客とする化石燃料企業は掘削や採掘、フラッキング(水圧破砕)など化石燃料開発を積極的に拡大しながら、依然として数百億ドルもの資金提供を浴びるように受けています。ウォール街の銀行、そしてMUFGを始め世界の銀行は、気候の安定した未来を台無しにすることに直接加担しています。今すぐ、これ以上の化石燃料インフラ拡大への支援は終わりにしなければなりません」と訴えました。

RAN日本代表 川上豊幸は「化石燃料インフラの拡大を行う企業へのパリ協定後の支援は、3メガバンク共に減少傾向にありますが、停止することなく継続しています。例えば、3メガバンクはサウジアラビアの国有石油会社のサウジアラムコに資金提供を続けています。このままではパリ協定の1.5度目標の達成が困難になります。またSMBCグループによる化石燃料ファイナンスの総額ではパリ協定採択から2020年まで増加し、2021年には減少に転じましたが、ロシア国営企業のガスプロムへの融資・引受額が2021年は世界2位、2016年から2021年は世界3位でした。一方、MUFGとみずほは2020年から2021年にかけて融資・引受額がむしろ増えています」と批判しました。

化石燃料部門別の傾向

●オイルサンド:警戒すべきことに、オイルサンドの資金提供額は2020年から2021年に51%増加して233億ドルに達した。大幅な増加はカナダの銀行であるRBCとトロント・ドミニオン(TD)によるもので、JPモルガン・チェースは引き続き主要な資金提供銀行だった。

●シェールオイル・ガス:昨年に621億ドルの融資・引受が行われ、ウェルズ・ファーゴを筆頭とする北米の銀行が中心となった。

●北極圏の石油・ガス:JPモルガン・チェース、SMBCグループ、インテーザ・サンパオロが、昨年の融資・引受額で上位だった。

●液化天然ガス(LNG):モルガン・スタンレー、RBC、ゴールドマン・サックスが2021年のLNG部門における融資・引受額で上位だった。この部門は一連の大規模インフラ事業を推進するために、銀行を当てにしている。

●海洋の石油・ガス:大手銀行は昨年、529億ドルをこの部門へつぎ込み、2021年は米国のシティとJPモルガン・チェースの資金提供額が最多だった。

●石炭採掘:中国の銀行が石炭採掘の融資・引受を牽引し、中国光大銀行と中信銀行が2021年の融資・引受額が最多だった。

※「メガバンクの部門別ファイナンス順位(2016-2021年)と2021年の傾向(2020年比)も参照のこと(注3)。

なお本報告書には、昨年ネット・ゼロ・バンキング・アライアンス(NZBA、注2ネット・ゼロのためのグラスゴー金融同盟<GFANZ>の一部)に加盟した銀行が、一方で、最も悪評高い石油・ガス拡大企業への資金提供していた事例も時系列で記載しています。こういった資金提供は、今後数十年にわたって地球が温室効果ガス排出継続に陥ることを促す可能性があります。2021年4月のNZBA発足からすぐに、多くの加盟銀行と加盟予定銀行が「ネットゼロ」達成に逆行するような以下の巨額の取引を行いました。

●2021年5月

○サウジアラムコ:100億ドル(シティ、JPモルガン・チェース)

○アブダビ国営石油:15億ドル(シティ、JPモルガン・チェース)

○サウジアラムコ:10億ドル(シティ、JPモルガン・チェース)

●2021年6月

○カタール・エナジー:1,250億ドル(シティ、JPモルガン・チェース、バンクオブアメリカ、ゴールドマンサックス)

●2021年8月

○エクソンモービル:1000億ドル(シティ、JPモルガンチェース、バンクオブアメリカ、モルガンスタンレー)

本報告書で対象とした60行の内44行は、「2050年までのネット・ゼロ・ファイナンス」による排出量削減を約束しています。上記邦銀4行も参加しています。また28行には、いまだ化石燃料産業のどの部門についても拡大を制限する重要な方針がありません。

世界の第一線の気候科学者たちは、化石燃料の埋蔵量は、残された「カーボンバジェット」(炭素予算)を超えてパリ協定が目標とする1.5度はおろか、世界を2度以上の温暖化に追いやり、気候変動による大災害を引き起こすのに十分すぎるほどの排出量を含んでいると結論づけました。

「世界の脱石油&ガスリスト」最新版は、上流の石油・ガス生産者の事業拡大は限られた企業に非常に集中している事実を明らかにしています(上位20社が化石燃料の開発・探査の半分以上を担っている)。そして本報告書でも、それらの上流の石油・ガス生産企業への銀行の支援も非常に集中していることを示しています(上位20社に資金提供している上位10行は、パリ協定採択以降、大手銀行から上記企業への融資・引受の63%に関与している)。上位10行はいずれも2050年までのネット・ゼロ実現を正式に約束しています。上位10行とは、JPモルガン・チェース、シティ、バンク・オブ・アメリカ、BNPパリバ、HSBC、バークレイズ、モルガン・スタンレー、ゴールドマン・サックス、クレディ・アグリコル、ソシエテ・ジェネラルです。

賛同団体からのコメント

気候ネットワーク プログラム・コーディネーター 鈴木康子

「パリ協定締結後、多くの金融機関は気候変動対策を打ち出し、TCFD提言支持を表明しました。しかし本報告書では、日本のメガバンクが気候関連リスクを優先事項と位置づけながらも、化石燃料関連の事業や企業への資金提供を続けている実態が明らかとなっています。気温上昇を1.5℃に抑えるために残された時間が着々と少なくなっている今こそ、気候危機を回避するためにSBT(科学的根拠に基づく目標)に基づく脱炭素・再エネの主力化を最優先で加速させる必要があります」

国際環境NGO 350.org Japanシニア・キャンペーナー 渡辺瑛莉

「本調査により、パリ協定の採択から6年を経てもなお、日本のメガバンク3行が、世界の化石燃料部門に多額の資金提供を続けていることが明らかとなりました。化石燃料の新規および拡張計画への資金提供を継続できる、銀行の現在の方針は、パリ協定の1.5度目標はおろか、銀行自らが掲げるネットゼロ宣言とも整合しません。1.5度目標を守るためには、プロジェクトレベルだけでなく、化石燃料ファイナンスの大部分を占めるコーポレートファイナンスも含めた厳格な方針の策定が急務です。銀行が気候危機の解決と気候関連リスクの管理に真剣ならば、脱石炭方針の抜け穴を塞ぐとともに、ガス・石油を含む化石燃料部門への投融資方針を気候科学に基づき、早急に改めるべきです。」

注1)「化石燃料ファイナンス報告書2022」

全文(英語)

https://www.bankingonclimatechaos.org

日本語要旨

http://japan.ran.org/wp-content/uploads/2022/03/BOCC_2022_Summary_vJPN.pdf

・取引データはブルームバーグ端末のリーグテーブル機能を用い、融資と引受(株式・債券発行)を集計している。融資・引受額は、対象となる化石燃料関連企業の当該部門の事業活動に基づいて割引して算出している。詳細は英語の「方法論」を参照のこと。

https://www.bankingonclimatechaos.org/wp-content/themes/bocc-2021/inc/bcc-data-2022/Methodology_FAQ_Banking_on_Climate_Chaos_2022.pdf

・本報告書はRAN、バンクトラック、先住民族環境ネットワーク(IEN)、オイル・チェンジ・インターナショナル、リクレイム・ファイナンス、シエラクラブ、ウルゲバルトが執筆し、世界50カ国500以上の団体が賛同している。

注2)日本でも、三菱UFJフィナンシャル・グループ、三井住友フィナンシャルグループ、みずほフィナンシャルグループ、三井住友トラストホールディングスなどが加盟している。

https://www.unepfi.org/net-zero-banking/

注3)メガバンクの部門別ファイナンス順位と2021年の傾向(2016年比)

*英文プレスリリース及び他の賛同団体のコメントは以下を参照ください。

https://www.ran.org/press-releases/new-report-shows-worlds-biggest-banks-continued-to-pour-billions-into-fossil-fuel-expansion-in-2021/

訂正:注3)「メガバンクの部門別ファイナンス順位と2021年の傾向」について、「化石燃料拡大100社」の各行傾向が「↓(下降)」となっていましたが、正しくは「↑(上昇)」でした(2022年4月1日)。

※更新:「化石燃料ファイナンス報告書 2022」日本語要約版を追加しました。同時に、図1および2を日本語版に差し替えました(2022年9月13日)。

団体紹介

レインフォレスト・アクション・ネットーク(RAN)は、米国のサンフランシスコに本部を持つ環境NGOです。1985年の設立以来、環境に配慮した消費行動を通じて、森林保護、先住民族や地域住民の権利擁護、環境保護活動をさまざまな角度から行っています。2005年10月より、日本代表部を設置しています。

本件に関するお問い合わせ

レインフォレスト・アクション・ネットワーク

広報 関本 Email: yuki.sekimoto@ran.org